Trading a specific segment of the week/day

- Korbinian Koller

- Feb 10

- 7 min read

We all need to find our niche on market participation depending on our psychological mental makeup and possible exterior factors.

While some focus on a specific instruments and aim to become the DELLionaire (or only trade the S&P minies)others trade a specific time frame

If you are limited with time and can't afford to be a full time trader you might even select just a specific time segment lets say only one day a week.

What needs to be clarified right away is that any limitation one puts on oneself in market participation is like an additional filter one adds to ones trading regime and the market doesn't care for your preferences

Meaning most just dabble as "investors" and become the herd of people who only pay money into the market as designed, simply never reaching the education and practice necessary to become consistent.

Other filters imposed bring with themselves limitations that need to be aware of

like if you choose to trade monthly time frames only you get relevant sample sizes of trades accumulated very slowly and as such it takes a very long tie to measure your success rate.

If you only scalp on 15 minute time frames and below you experience a very extreme border of the market that has a lot of impediments both psychologically and even more in price behaviors that reduce your rate of success

These being extreme example of time frames other extremes are tricky as well

lets say for for arguments say you decide only to trade Mondays or Fridays of the week you also participate on the borders of the week another extreme

It is essential to be aware of such filters and instead of becoming pray to them find rather the advantages and edges for oneself to not add even more of a learning curve to ones trading success.

One phenomenon I noticed in my over thirty years of market participation that there is never a good time to start to trade, meaning I always found myself going at the wrong time on vacation, coming back at the wrong time after sabbaticals, take breaks from trading after loosing streaks or back testing periods or system development.

While this might still seem like guided by possible logic like for example trading in off sequence like creating a system and when its done entering the next bigger market cycle phase that invalidates this system and losing money resultingly, latest at times of when one gets sick and returns to the market being way off and alike does not represent logic whatsoever and it is a fact that full time traders rarely take breaks since they all experienced this Murphy's law of trying to start trading and always picking just the worst starting point.

This obstacle is overcome if simply accepting it and either paper trading only or starting out with real small size and adding patience and perseverance For argument sake lets say a trader picks to trade Fridays only, he would need to consider in addition to the above mentioned, to back test Fridays all on their own.

With Friday being the last day of the week, cut off times squeeze larger traders to reduce risk for holds over the weekend and a multitude of irregular price behaviors in opposition to the average trading occur.

One of them being the "give back Friday" rule.

If we focus closer in and lets say only trading the final session does allow so for additional edges it being the last segment of the week where the last 90 minutes of trading are provided with the edges of knowing prices will close for both the day and the week and maximal data provisions as an result (it is always easier to trade a close versus an opening of the day or week

Most important in all instances is to have a top down approach to the market meaning to not lose sight of the bigger picture-in our case how did prices behave in the first two segments of the day, how did prices trade in the week of participation and where are we in cycles.

Secondly never put a filter on the market of your personal preferences of any emotion or direction

Lets say you want to add to your portfolio a specific instrument or reload into your exposure the market going down and you wanting more long exposure collides if you insist on your timing rather than wait for a markets opportunity supporting the long side

in short if you would be stepping to a Friday approach right now, you would be challenged that

markets go through rotations of phases

you have been stepping in into the last phase of a sideways zone in crypto for example with BTC being strong and crypto being weak

You also are trading at a phase where the smaller time frames are suppressed by larger players and right now with price trading in the middle of the sideways zone

besides Sunday openings, Fridays have been recently the least opportune days for smaller time frame trade placement

It would be especially hard trying to trade the markets from the long side only as we discussed in detail in our last live call on last Thursday for a variety of reasons.

Just because you might want to trade that one day of the week and the long side, consider the market doesn't care.

As long as you stay patient, come into neutral and trade from both sides long and short you should be fine.

We are dealing with a lot of volatility right now but little direction-which could change soon but would be another obstacle for right now as a starting point (and we already know there is never an ideal starting point)(just trade paper or very very small in position size when you start out trading)

In this next segment to this topic I will provide an example of system development for personal preference niche trading In our example case we continue choosing one of the weeks extreme day(Sunday opening, Monday, Friday), in this example:

Friday

as usual us a top down approach

(like larger market picture of higher time frames and trading behavior of the previous days to the Friday in question and alike)

do not stack extremes onto extremes like if the Friday is also end of month or involved into a roll over

after all the HTF evaluations in general and with the regular weekly and daily call in particular for practical execution hierarchy process blocks as precursors to your system,

start extensive back testing to gain knowledge about your specific niche trading

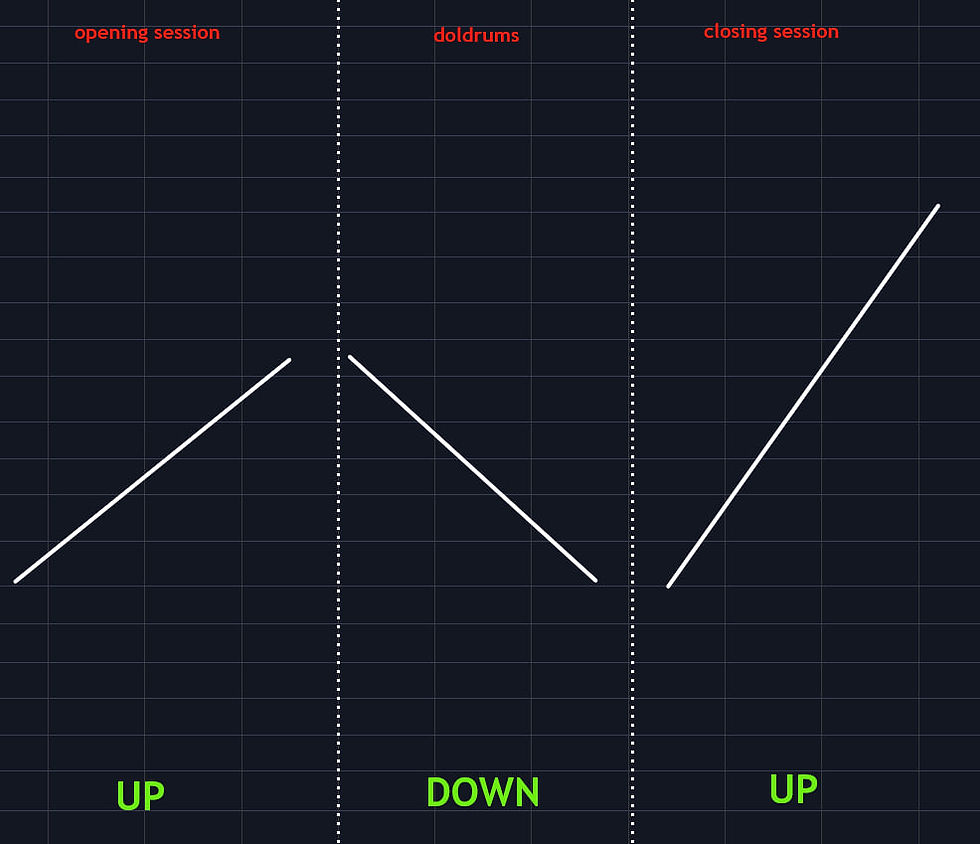

first select a time segment in this example we will select the third and final session of Fridays,

this gains the edge that this segment entails a maximum data flow of the first two sessions of the day for the trader which stacks the edge of success for the final sessions participation

I do not recommend to only represent in trading view or your charting software of choice time sessions that only entail the last 90 minutes of Fridays or even isolated Fridays since back testing always brings "surprise" learning data that leads up to your trading niche time segment.

start out a hierarchy of back testing sheets that clarify the momentary of time cycle within market cycles meaning:

check back for a few years every Fridays price outcome if prices closed bullish, bearish or break even

look for cycles repeating like cyclical and alike

than zoom in and check how the previous two sessions behaved in the three segments of bull days , bear days, and sideways days, like: bull days for example:

bull days meaning the final session closes the entire day in the green

this example would be a classical trend day

and you need to examine all other options like:

sideways sideways up

sideways up up

up sideways up

down down up

sideways down up

down up up

up down up and so forth

and than the more refined groups like:

in a scenario of

up down up

does the doldrums down leg take the opening sessions lows out or not:

= three scenarios:

higher low than low of the day:

double bottom:

new lows in doldrums:

With these first inquiries you get a feel for the specific market or trading instrument within the week, month and year/years.

next you want to examine the probabilities of turning points for doldrums changing into the closing session since this typical reversal time will provide for the highest likely entry scenarios of your system

check the highest likely scenarios of the three ways of double bottoms (for long entries as an example) first in regards to occurrence probability and MAE (maximum adverse excursion= how far after the entry the trade typically goes against you since this will determine your minimum stops sizes and do this for different volatility and range parameters that you can gain from the first two previous session data)

after similar price examinations check for different typical pattern behavior at the end of the doldrums like lets say in all trend scenarios where either the first or the second session is going up and a third session continuation is to be expected-like early time breakouts, triangles and alike and verify what the most low risk entries are suitable for your trading system and trading instrument selection

When done with price start examining time and volume and transactions and fractals and so forth until you come to a good feel of how you will stack edges for your specific time segment of the week and day you have chosen to trade

One of the most important aspects of back testing is not trying to be efficient

this meaning that I make sample sizes no smaller than 1000 for it to be a meaningful average and nothing done with back testing software-I do my entire back testing by hand

while some computer nerds might think this being a waste of time I stand behind my firm belief and experience that actually checking the charts not only brings forward extremely valuable data that you weren't specifically looking for and these "surprise findings" to be the most valuable ones=new edges and so forth

secondly all computers look under an algorithm and as such already project a filter on the chart-something always to be avoided

this also implies as a back-tester to be in the same emotionally neutral state as if you were executing to avoid the "blue car syndrome"

most importantly these back testing hours are highly valuable screen time that is very much different in a non moving market representation over a forward tested segment where prices are in flux and as such trigger all sorts of observation variant within the observer

At this point I assume the reader to be getting an idea on how to improve a filtered participation in the market in our case the final session on Fridays only and in what direction one needs to look to refine special edges that might be applicable this this specific time segment.

similar routes are to explored if not filtering time but rather market niche by sector or instrument and further on

Virginia Woolf said, “Arrange whatever pieces come your way”.

Comentarios