Top down

One of the biggest problems in trading is that the overwhelming complexity in an uncertain environment leads to behavior that tries to gain certainty by focusing on the more controllable details.

Only a top down approach though with a hierarchy of rules and procedures leads to a true edge and a behavior that makes scanned edges to be executable.

A dominate role plays the daily prep of anticipating tomorrows market. This serves the purpose to look with a fresh mind in a neutral fashion at a nonmoving market.

To achieve such neutrality and not have the mind play tricks on oneself (red car syndrome) it is best instead of looking for something to match a past event or any other pattern recognition to rather look what is not likely to happen and as such be left with the highest likelihood of what might happen.

This elimination process leads to a much higher probability of future events than seeking after desired outcomes.

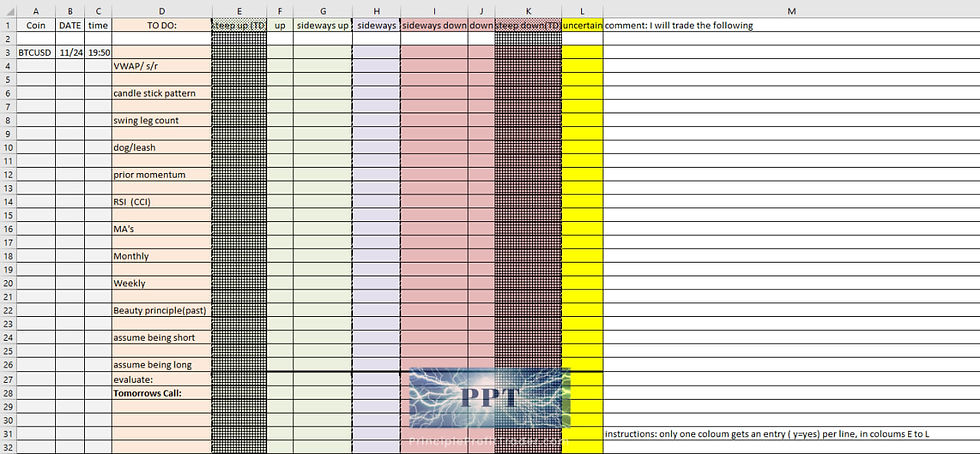

For intraday intended event execution it is best to view a daily chart and categorize the highest likelihood of tomorrow’s candle. THE DAILY CALL :

Doing so should include the follow techniques:

Monthly and weekly chart direction

An assumed short position for benchmark of how resulting emotions would relate to tomorrows events

An assumed long position for benchmark of how resulting emotions would relate to tomorrows events

Price in relationship to standard deviation (dog/leash)

Price in relationship to swing leg count (the higher the count the higher the probability of a pause/reversal)

Price in relationship to a directional indicator (i.e.:MA’s)

Price in relationship to non-directional indicator(=oscillator) (i.e.:CCI)

Price in relationship to support/resistance (i.e.:VWAP)

Price in relationship to today’s momentum

Todays and recent day’s candlestick pattern

Price behavior at previous similar events in time (beauty principle)

In each instance visualize a completed future candle and eliminate those who do not qualify for a familiar chart pattern to be left with the highest likelihoods.

The resulting candle(candles) :

(sideways, sideways down, down. steep down(TD),up ,steep up(TD) )

Each of these calls will provide for clear instructions of what to look for when engaging into the next day’s price actions and eliminates a group of setups and trades that are simply unwise to take in the previous price patterns giving a probability for direction and events.

As such a procedure like this has a trader to be prepared for the likely to be expected market behavior and be in an anticipatory rather reactionary manner partaking in the markets which avoids in stress situations to react intuitively which is counter probability, the market being counter intuitive in principle. Notes:

In short the “daily call “ provides two major advances-It sets a probabilistic expectation that keeps one in check to not trade against the grain. The main goal is to not fade a directional day which is exactly the opposite set of instructions than fading highs and lows on a sideways day. So the call of the higher likelihood if it is more likely to be a sideways day or more likely to be a directional day makes a huge difference in regards to “what not to do”.

It is risk that needs to be taken care off not gains.

This is based on the principle that one needs to make a 100% to be at BE when only having lost 50%.

This paired with the phenomenon of the blue car syndrome that we cannot perceive the market correctly when we aim at matching expectancy patterns makes this procedure so valuable.

Be aware that there are many subgroups meaning as usual markets are complex but cannot be entirely solved rule based-if you for example find yourself in a contracting market a sideways call can be in a triangle situation result into futile instructions since a double bottom entry rule would be literally violating the probability rule by the second part of a bottom already being a broken trend line as an entry so this sheet is far from complete in its instructions but merely gives a simple entry method into the new way of thinking and conditioning ones behaviors.

On the other side this sheet also provides already the guidelines to proper conditioned entry methodology all the way to 1 min and below since the rules are principle based and as such transferable to all timeframes

So in a way this sheet can be seen as the Holy Grail as long as it is understood that it is extremely hard to condition and implement.

It is so a very strong guide into the right direction for consistent profits

PS.:

Principles of the Daily Call

• Top down approach (timeframe) assessment of the market

• Highest probability calls for next trading session of market behavior (sideways, up, down)

• = clear instructions of what not to do and what to do for the next trading session

• Fill out the excel sheet

Filling out excel sheet comes first

Pragmatically and unemotionally

Fill out sequentially (top down with the sequence of “most confident with”-tools first)

1.) VWAP

Price above + near VWAP/support = up or sideways up

Price below + near VWAP/resistance = down or sideways down

If price is not near VWAP = sideways

2.) Candle stick pattern

Doji = up or down

Bullish engulfing pattern = up

Dark Cloud Cover = down

…

…

3.) Swing Leg count

After four legs market exhausted = sideways (leg = direction + candlestick bar color alternation)

More than 4 or 5 candlestick bars of the same color, generates a POI = sideways/up

4.) Dog / leash

Measure this by moving averages

Price far away from moving average = price moves back to moving average

= long or short (directional)

If price is near MA’s = sideways

5.) prior momentum

If momentum candle down = up

If momentum candle up = down

6.) CCI

(see sheet:”7 Hierarchy (KKP)”)

7.) Moving Averages

If price at & and above moving average = up (=support)

If price at & below moving average = down (=resistance)

If price between moving averages = sideways

8.) Monthly

Draw trend lines (higher highs and higher lows =up trend

Lower highs and lower lows = downtrend

Equal highs and equal lows=range=sideways

Higher highs and lower lows=triangle=sideways)

9.) Weekly

Draw trend lines (higher highs and higher lows =up trend

Lower highs and lower lows = downtrend

Equal highs and equal lows=range=sideways

Higher highs and lower lows=triangle=sideways)

Looking for possible POI where weekly players might step in

10.) Beauty Principle

Principle: events occur in pairs

crowd behavior

gap fill

candle stick patterns

etc.

How did price behave at similar price levels in the past

General market structure

11.) Assume being short:

Feeling good = down

Feeling uncertain = sideways

Feeling bad = up

12.) Assume being long:

Feeling good = up

Feeling uncertain = sideways

Feeling bad = down

Comments